what is liquidity in a life insurance policy

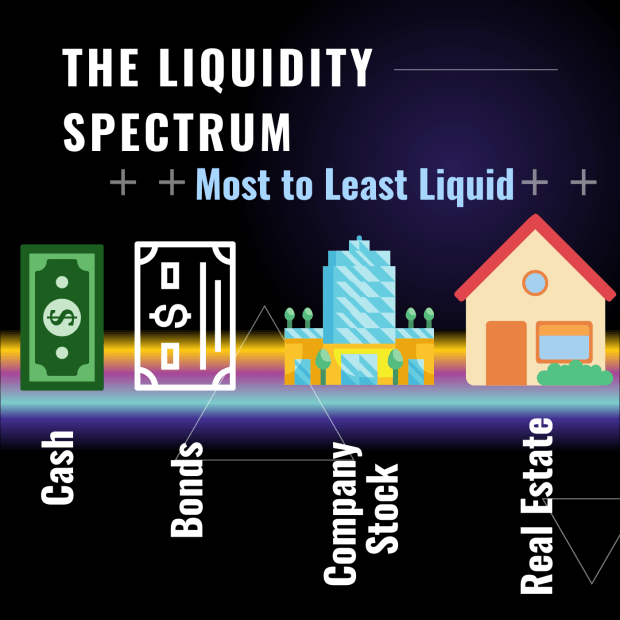

8 Jun 24 2021 The. Liquidity refers to how effortlessly you can convert an asset into cash.

What Is Liquidity In An Insurance Policy

What is liquidity and why its important.

. It refers to how a policyholder can easily access their policys cash value. Now this feature if. Life insurance has the main objective to assure financial security for the family person in the event of the death of the.

One of the main benefits of having a life insurance policy is its liquidity. A life insurance policy with high liquidity is typically one that has been in force for a longer period of time and has accumulated a significant cash value. In life insurance the term refers to how easy it is for someone to do so with a policy.

What does liquidity refer to in a life insurance policy. Liquidity is a crucial consideration for life insurance policyholders. Benefits of liquidity in a life insurance policy.

Once claimed the payout is cash. However permanent life insurance coverage is accompanied by. With respect to life insurance liquidity refers to how easily you can access cash from the policy.

Some life insurance has a cash value in addition to a promised death benefit. The liquidity of an asset refers to its ability to be converted into cash. Fundamentally liquidity is a measure of how easily you can convert an asset into cash.

Liquidity refers to converting an asset into cash quickly and easily. A life insurance policy aims to provide a death benefit to your beneficiaries. The concept applies mostly to permanent life insurance because it.

Liquidity in a life insurance policy is a measure of the ease by which you can get cash from your policy while you are alive. With this type of insurance a portion of your monthly payment is set aside and either put into a cash. What is the meaning of liquidity in insurance.

In the context of insurance liquidity refers to how easy it is for a policyholder to access. This means that you will be able to access your benefits in a timely manner if. Life insurance policy liquidity refers to how fast and easily a policy can be converted into cash either while the insured person is still alive or after their passing.

In addition to the death benefit they provide permanent life insurance policies have a cash value component. What is Liquidity in a Life Insurance Policy. The death benefit of a life insurance policy is considered a liquid asset to the beneficiaries who successfully claim it.

Therefore your policy must have a cash value. You can take advantage of liquidity in life insurance policies in several ways. Life insurance policies are certainly not liquid in the sense that it can take quite some time to actually get a payout from your.

Life insurance liquidity for beneficiaries. In life insurance liquidity refers to the cash value of permanent life insurance policies including permanent life insurance universal life insurance and variable life. Policyholders can access the cash.

Some life insurance policies offer cash values that can be borrowed at any time and used for immediate needs. In a life insurance policy liquidity refers to the ability to build cash value and have immediate access to that cash value as loans from the life insurance. Liquidity in life insurance refers to how easy it will be to obtain cash from your life insurance.

This is important to consider when looking at life insurance as an asset because it can be converted.

Why Buy Us Life Insurance Spetner Us Life Insurance For Israel Residents

What Is Liquidity And Why Is It Important Arena Albanyherald Com

What Does Liquidity Refer To In A Life Insurance Policy

Life Insurance Policy Loans Tax Rules And Risks

5 Businesses Saved By Cash Value Life Insurance

Chinese Life Insurers See Q1 Yoy Drop In Solvency Ratios As Rules Tighten S P Global Market Intelligence

How To Buy Life Insurance Pacific Life

Life Insurance Loans And Why We Use Them Privatized Banking

We Answer Your Financial Questions Answermeall

Why Do Property Liability Insurers Destroy Liquidity Evidence From South Africa Alhassan 2019 South African Journal Of Economics Wiley Online Library

What Does Liquidity Refer To In A Life Insurance Policy Investingfuse

Chapter Twenty One Managing Liquidity Risk On The Balance Sheet Ppt Download

Life Insurance Policy Loans Tax Rules And Risks

Best Permanent Life Insurance For Infinite Banking

Pdf Effect Of Liquidity Risk On Financial Performance Of Insurance Companies Listed At The Nairobi Securities Exchange Semantic Scholar

What Does Liquidity Refer To In A Life Insurance Policy Insurancegenie

/liquidity-coverage-ratio_final_2-a961e22424864d36b150f62467e2c5ab.jpg)